Quarterly Tax Payments 2024 Iowa

Quarterly Tax Payments 2024 Iowa. The latest state tax rates for 2024/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states. The itat quarterly newsletter is brought to you by the county treasurers of iowataxandtags.org.

The dates don’t align with regular. This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Included In The Table Below Are The Instructions For Filings Made In 2024.

High income taxpayers an individual is a high income taxpayer if the.

Enter Your Gross Salary, Pay Frequency, And Other Relevant Details To Calculate Your Net Income After All State And Federal Taxes.

When should you make quarterly tax payments?

In General, Quarterly Estimated Tax Payments Are Due.

Images References :

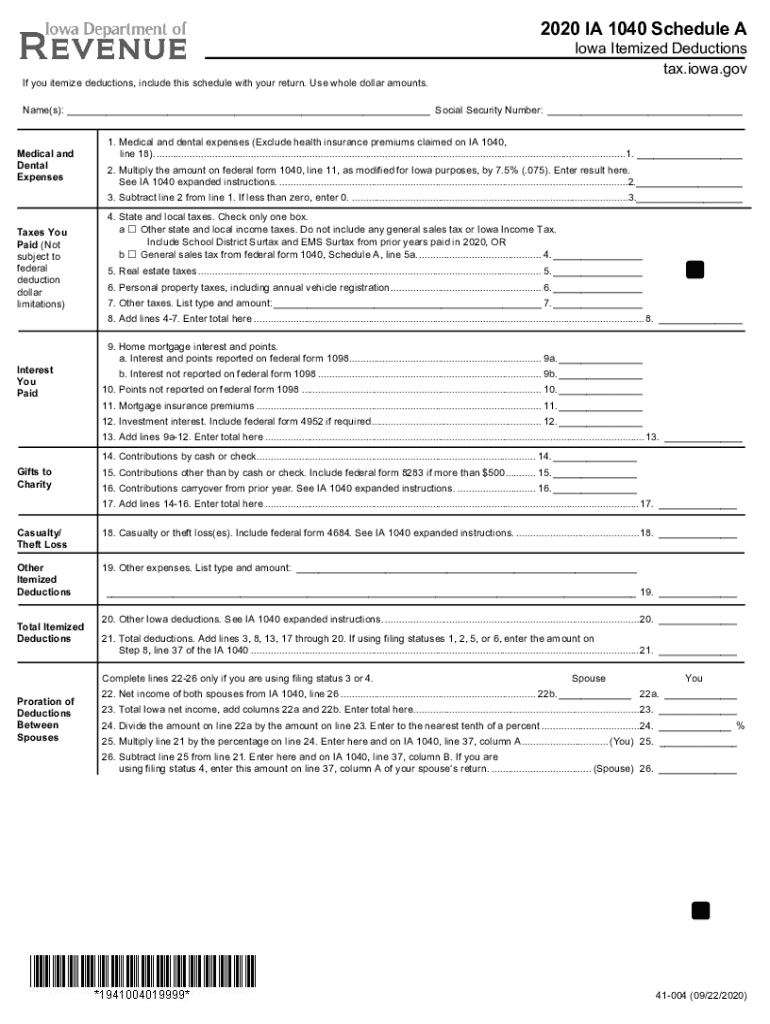

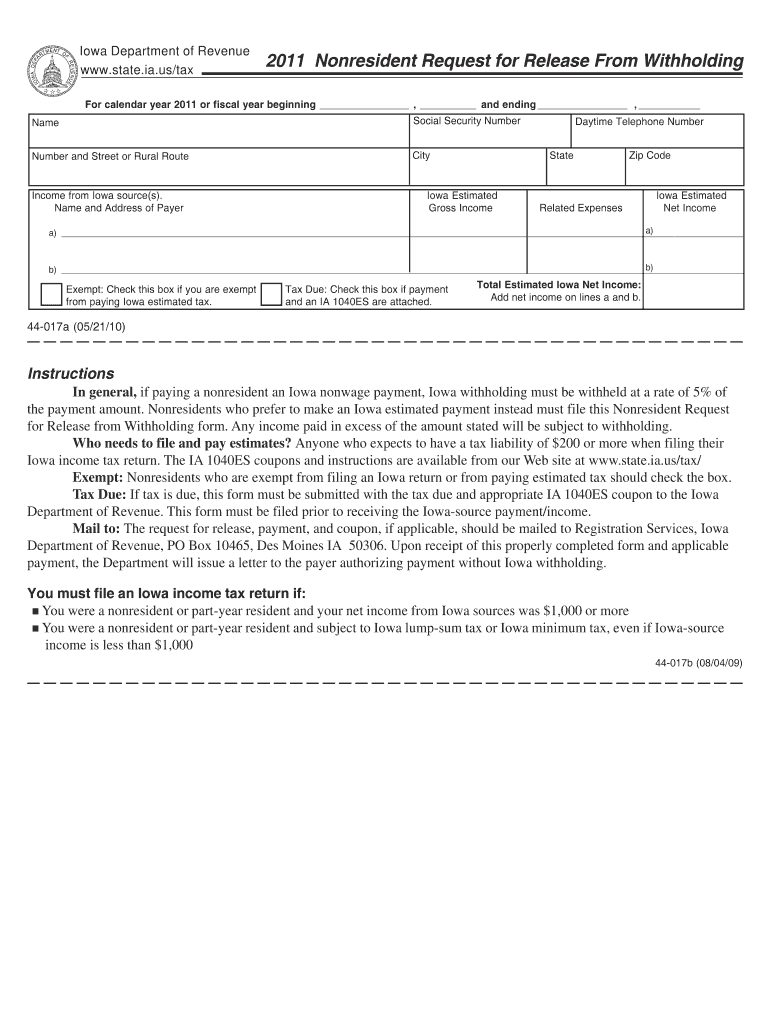

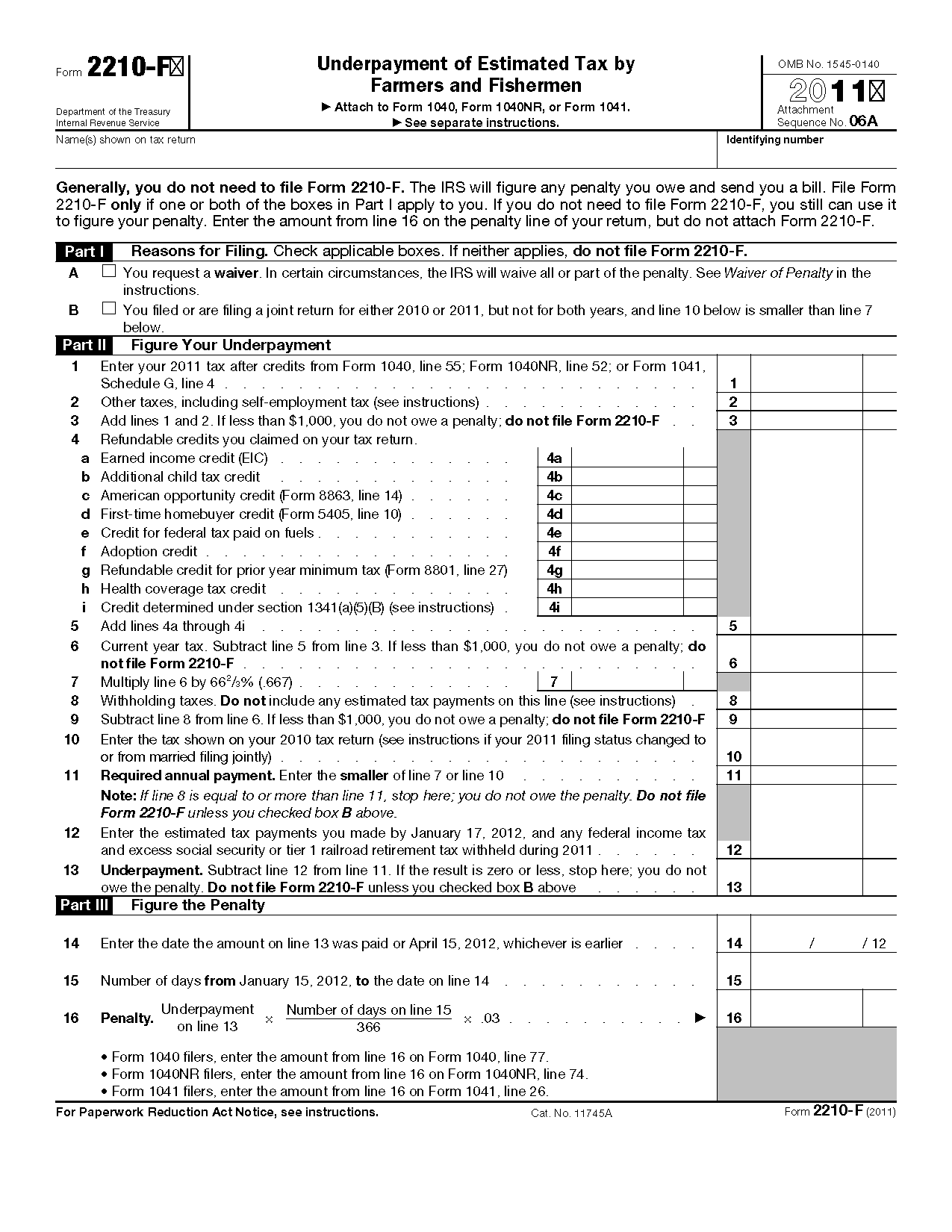

Source: www.dochub.com

Source: www.dochub.com

Ia 1040 form Fill out & sign online DocHub, The combined fica tax rate for 2024 is 7.65%—6.2% for social security (oasdi) and 1.45% for medicare (hospital insurance). Locate your company type and follow the instructions in the filing memo and annual.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, The irs sets deadlines for estimated tax payments on a quarterly basis. Welcome to the itat quarterly!

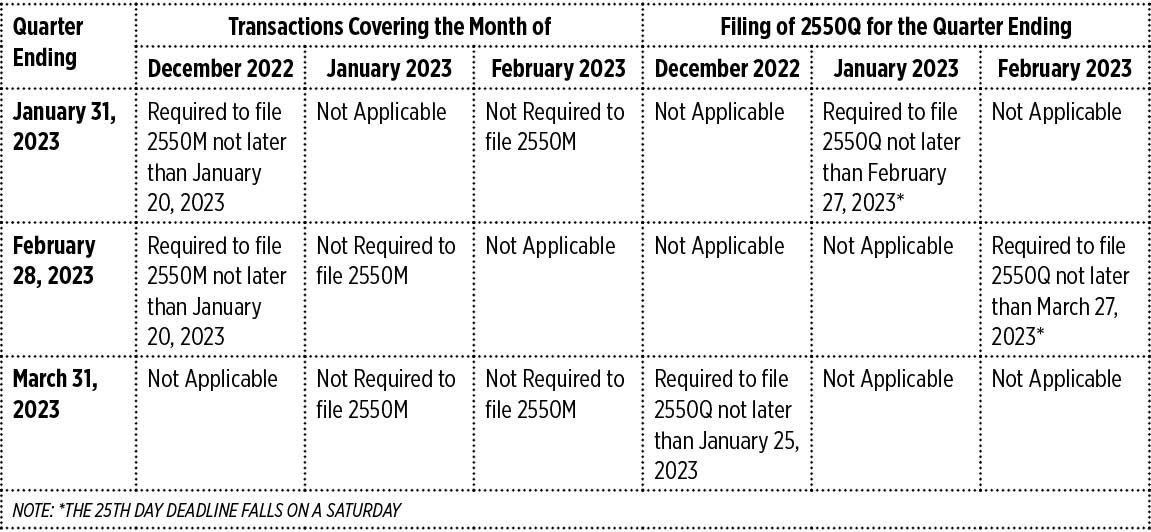

Source: www.bworldonline.com

Source: www.bworldonline.com

A closer look at quarterly VAT filing BusinessWorld Online, When should you make quarterly tax payments? Welcome to the itat quarterly!

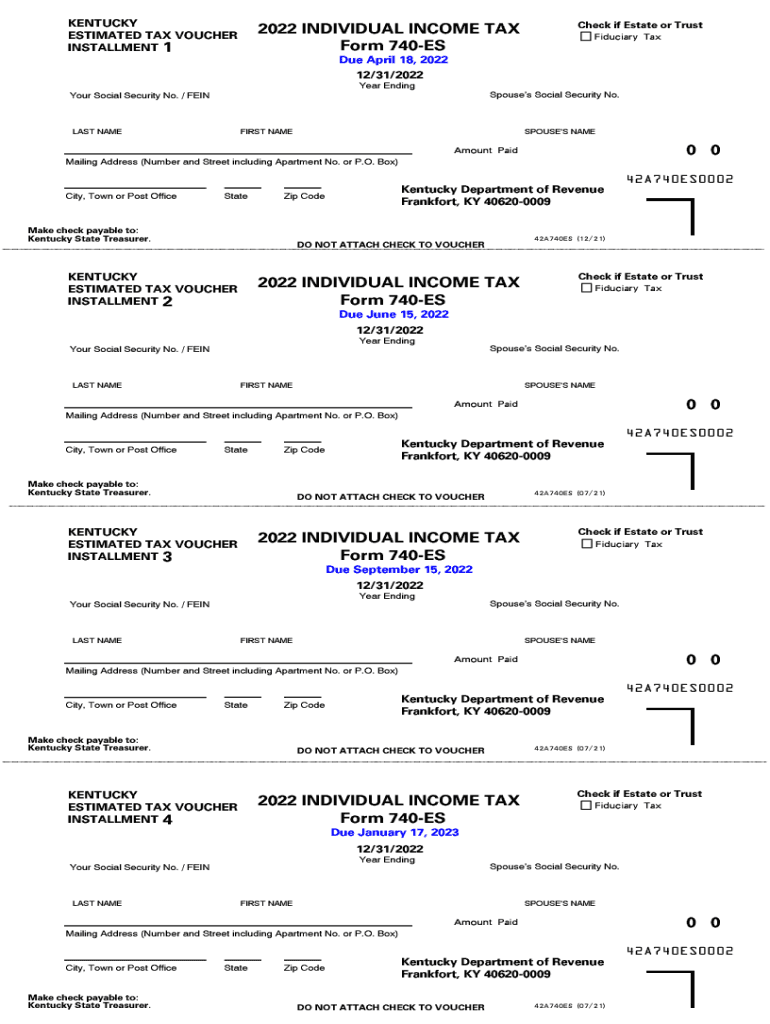

Source: www.signnow.com

Source: www.signnow.com

Ky 740 Es 20222024 Form Fill Out and Sign Printable PDF Template, Federal return processing and iowa’s income tax season began on jan. The income tax cuts signed by reynolds in 2022 are a step toward a 3.9% flat income tax rate by 2026.

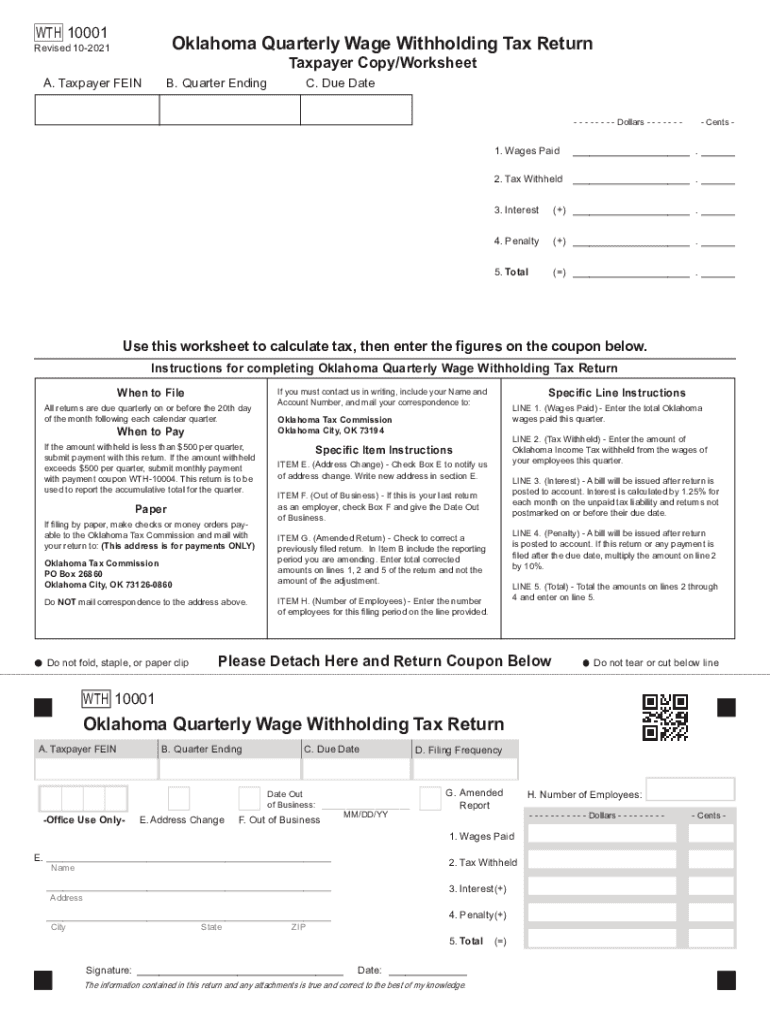

Source: www.signnow.com

Source: www.signnow.com

Oklahoma Quarterly Wage Withholding Tax Return 20212024 Form Fill, Federal return processing and iowa’s income tax season began on jan. In 2024, estimated tax payments are due april 15, june 17, and september 16.

Source: www.signnow.com

Source: www.signnow.com

Ia 1040es 20192024 Form Fill Out and Sign Printable PDF Template, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. All publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, In 2024, estimated tax payments are due april 15, june 17, and september 16. This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, Iowa state income tax tables in 2024. The house proposal is about $35 million higher than reynolds’ budget plan released at the beginning of the 2024 legislative session, which included.

Find Out The Penalty For Not Making Quarterly Tax Payments, The house proposal is about $35 million higher than reynolds’ budget plan released at the beginning of the 2024 legislative session, which included. Welcome to the itat quarterly!

Source: taxwithholdingestimator.com

Source: taxwithholdingestimator.com

IRS Estimated Taxes Tax Withholding Estimator 2021, The iowa tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in iowa, the calculator allows you to calculate. 2) the current tax year payments, made on or before the due dates, are at least 90% of the tax on the current year's annualized taxable income as determined on form ia 2210.

The Income Tax Rates And.

The corporate tax rates will drop from 8.4% to.

The Final Quarterly Payment Is Due January 2025.

For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines.